SALES REVIEW

Consolidation

There remained plenty of money about in 2023, even if the astronomical figures of 2022 were not matched

Words: John Berry

TATTERSALLS FEBRUARY SALE

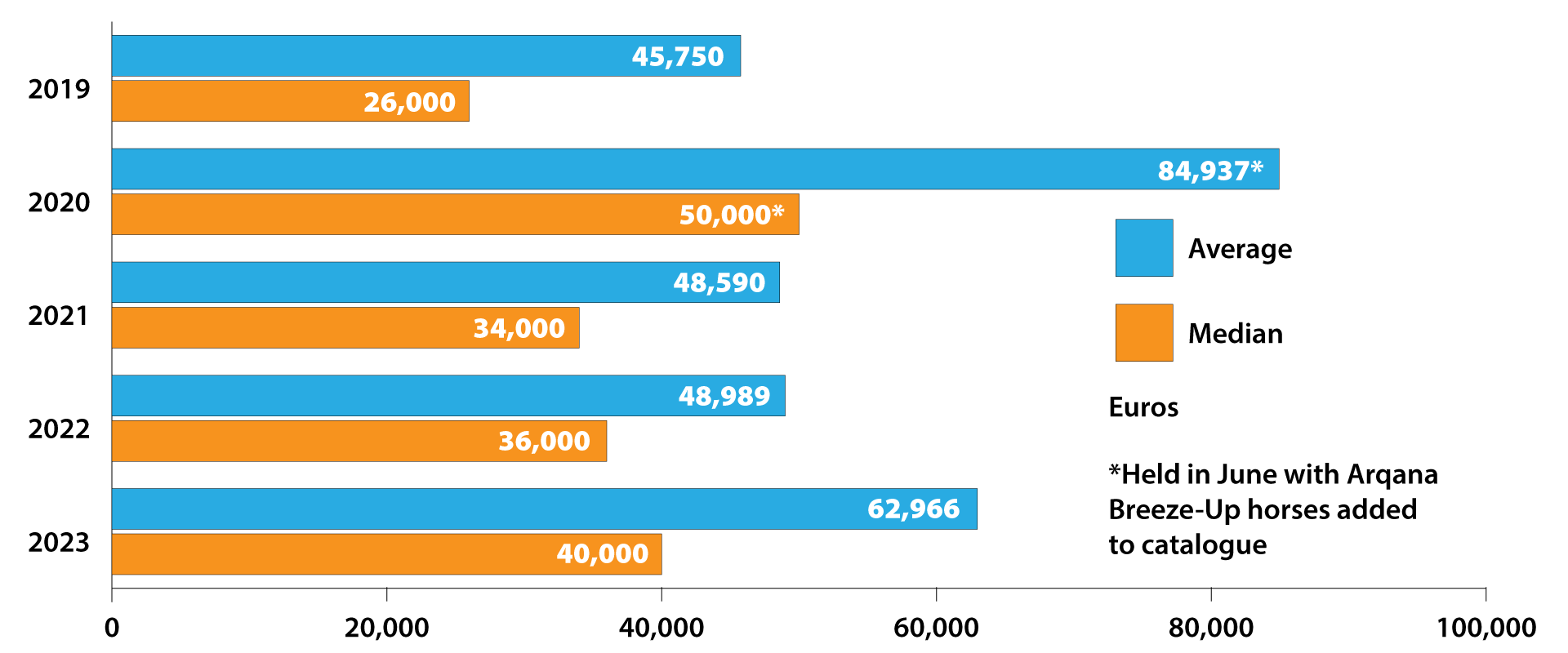

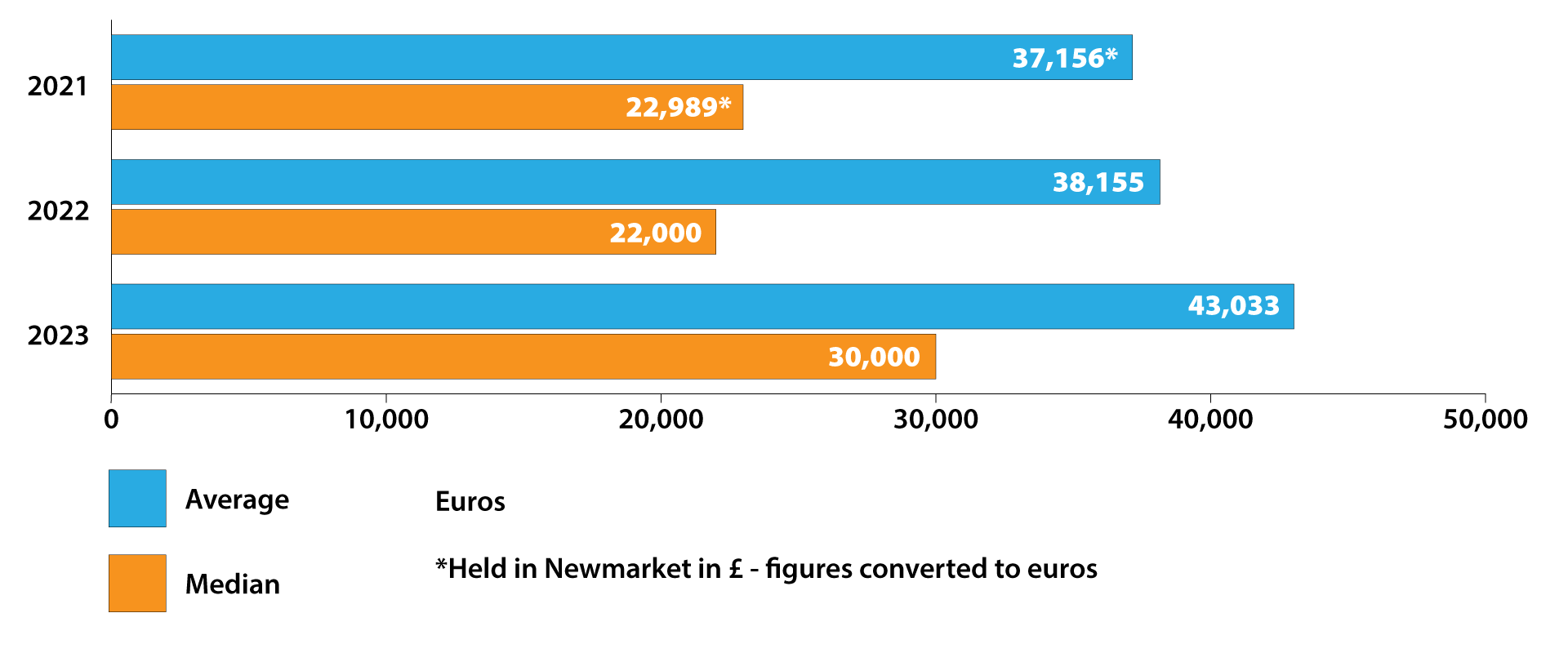

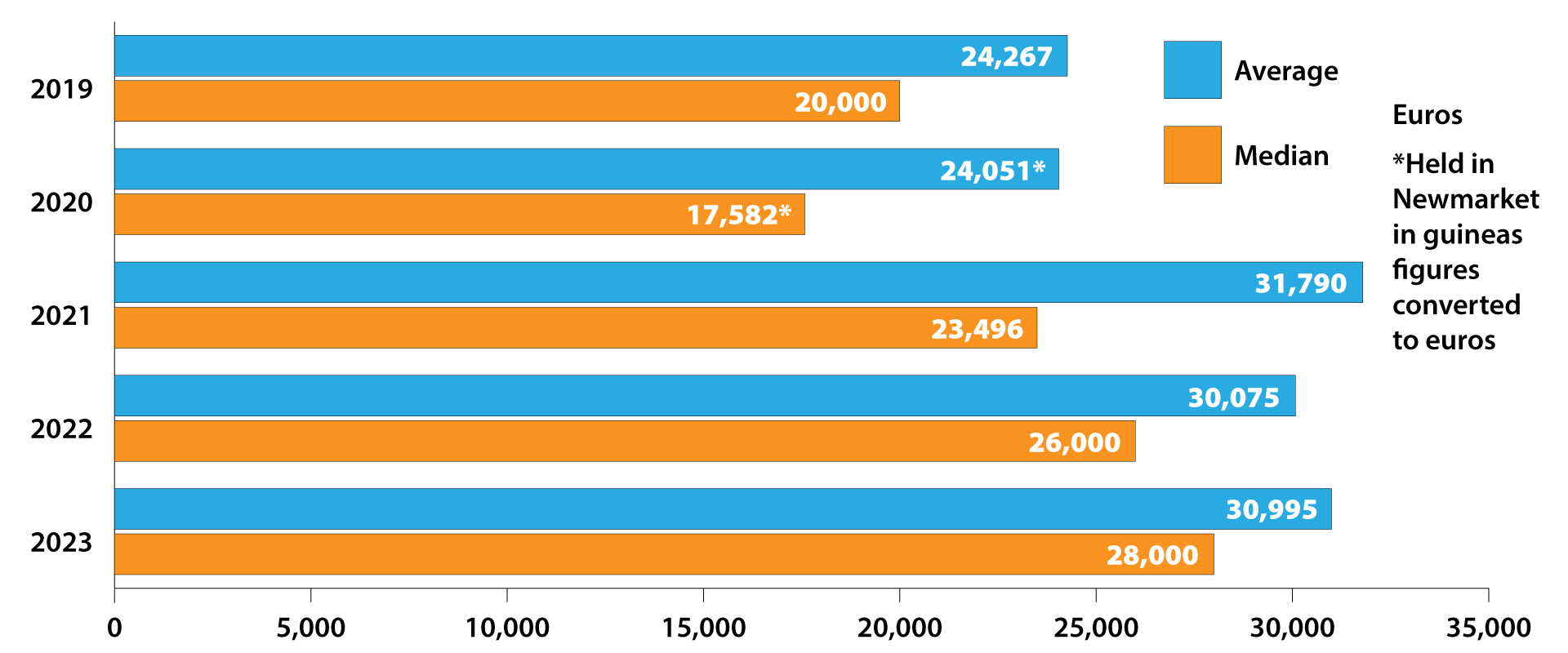

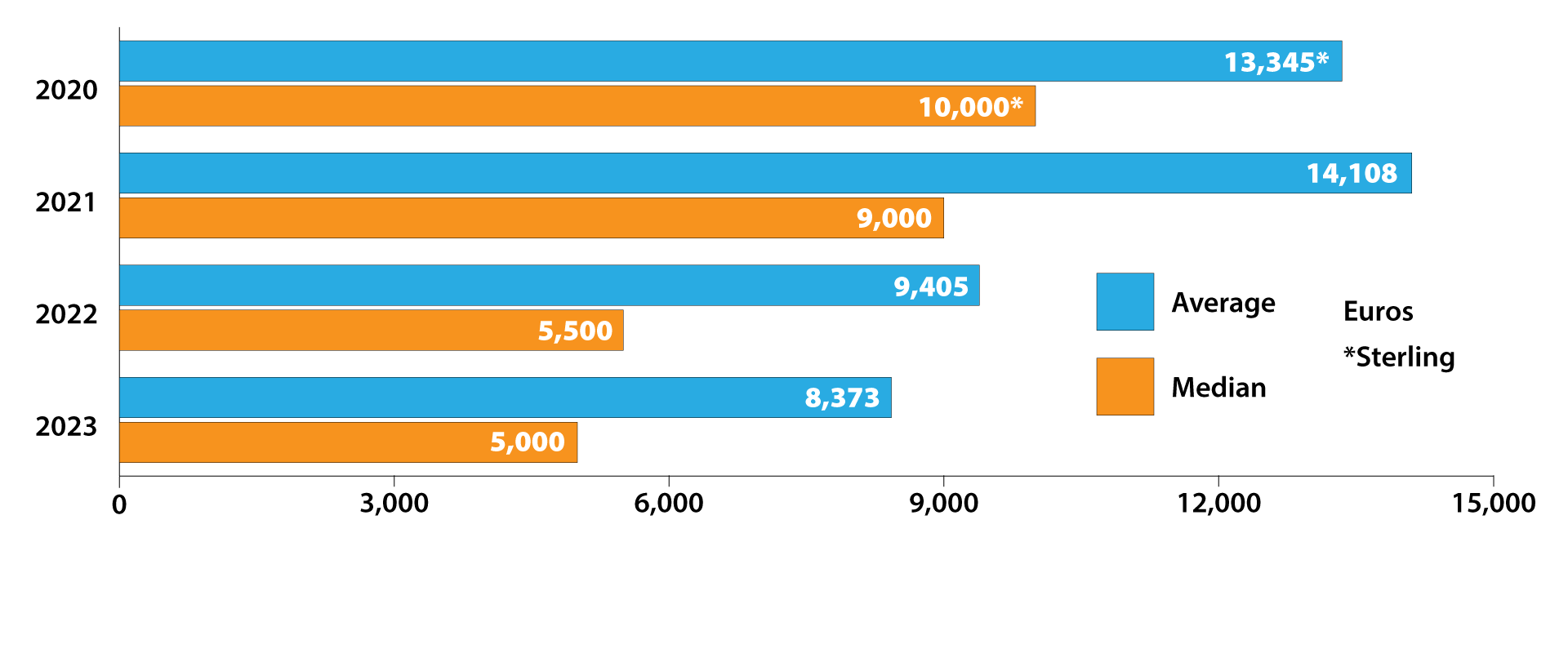

The first major sale of the year is Tattersalls’ February Sale, much expanded in recent years (like so many other sales). It generally provides an interesting guide as to what might lie ahead AND gave a solid pointer that, while there was still going to be plenty of money about, the astronomical heights of the market in 2022 might not be matched in 2023.

BREEZE-UP SALES

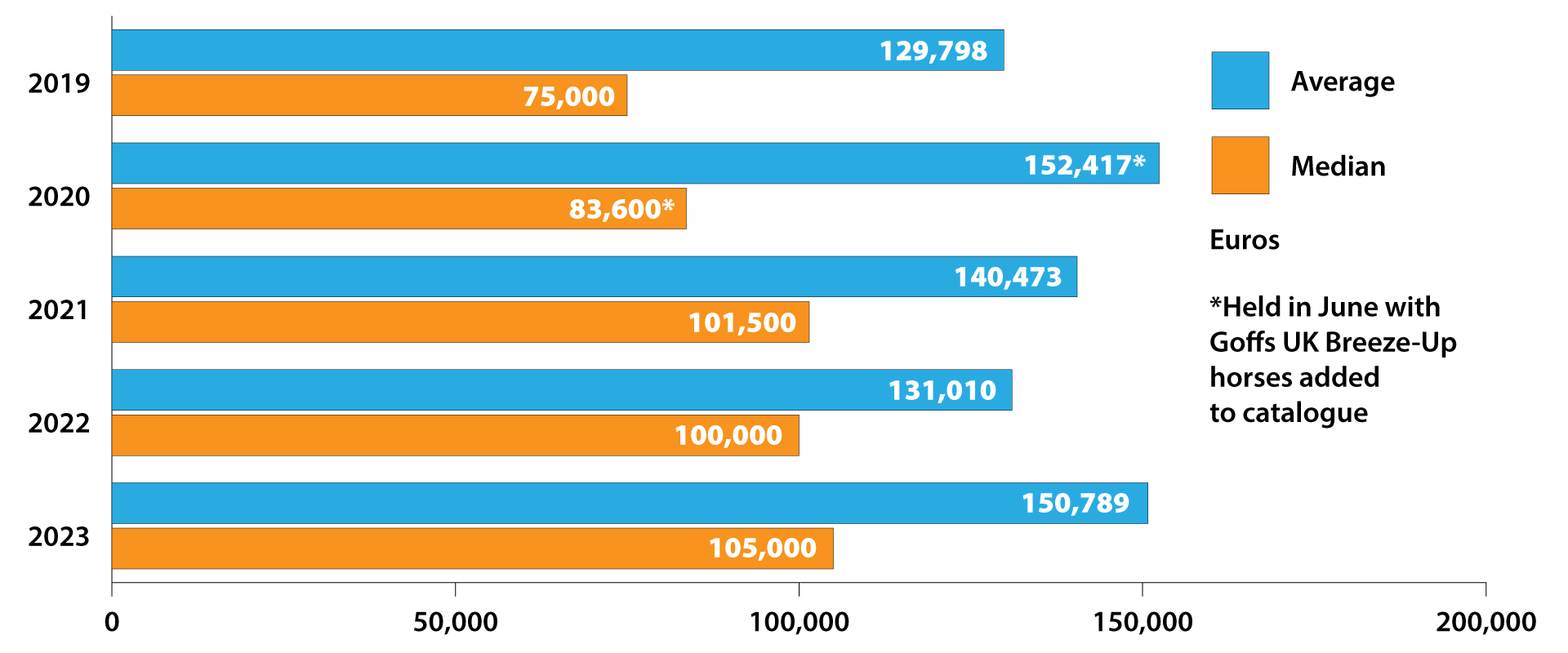

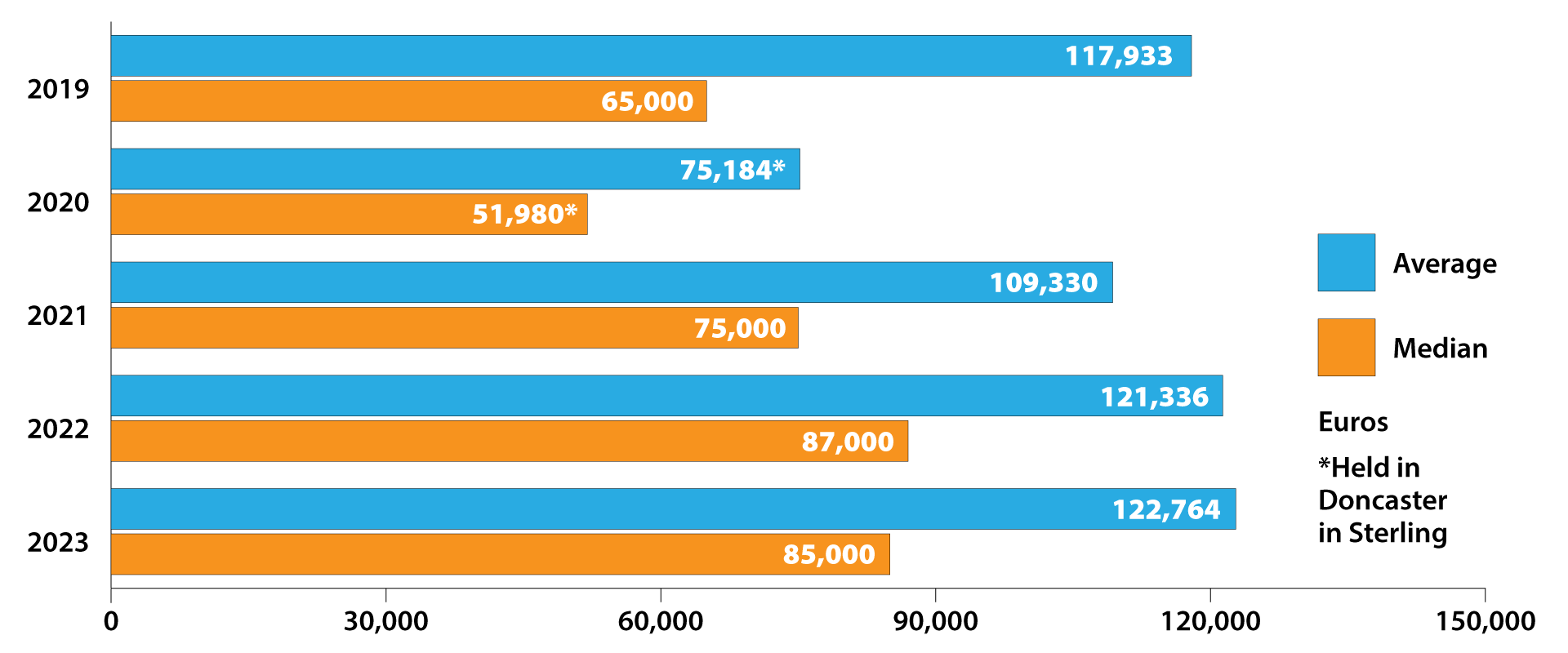

The returns from the February Sale might have given breeze-up vendors slight cause for concern, as any downturn in the market from one year to the next may be felt by them immediately, the horses whom they offer generally having been bought the previous autumn. Tattersalls’ Craven Breeze-Up Sale, though, should have calmed any nerves because trade was very strong. The catalogue was expanded by nearly 25%, which in general might be expected to see both the average and the median reduced, on the basis that the extra horses included would be ones previously deemed not good enough for the principal sale. Even so, while the median figure did come down, the average was up, which was remarkable. The aggregate showed a massive increase: 11,939,500 guineas to 15,357,500 guineas. Happily, for vendors, this set the tone for the rest of the spring.

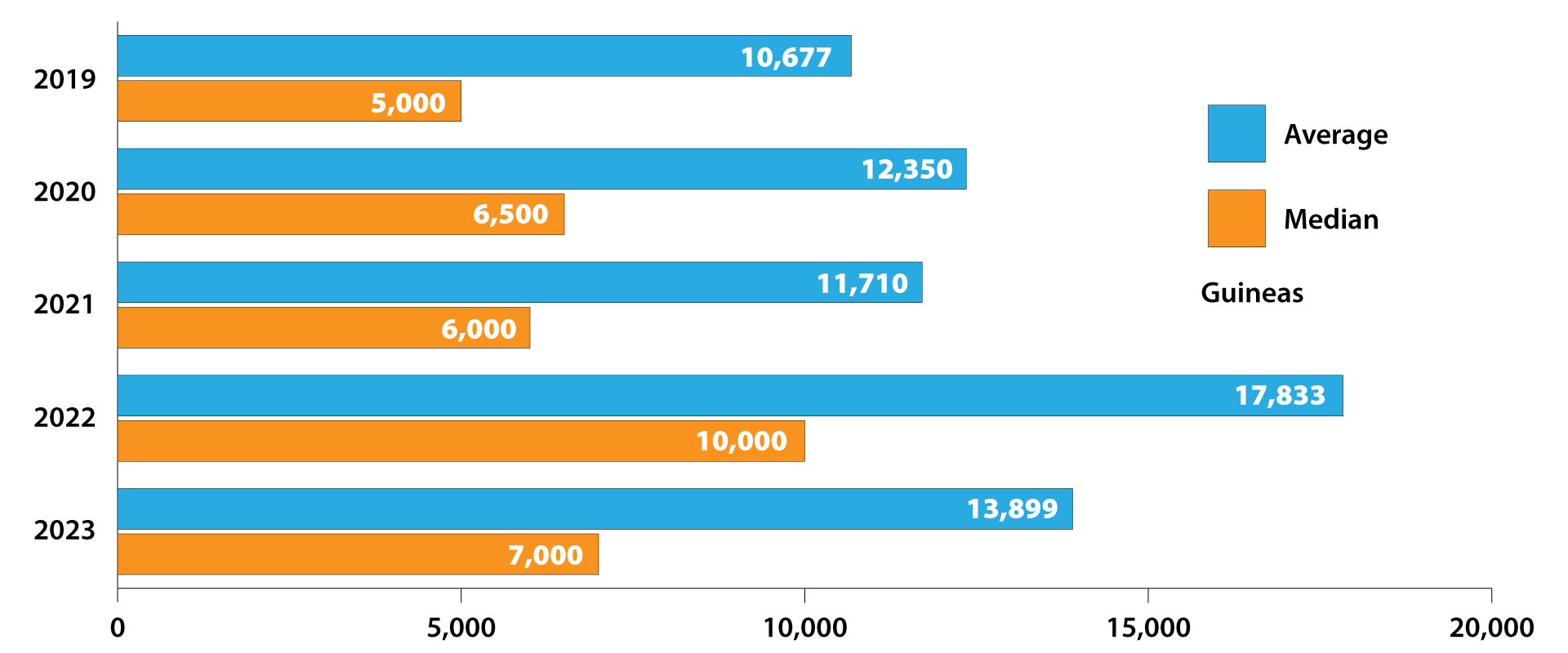

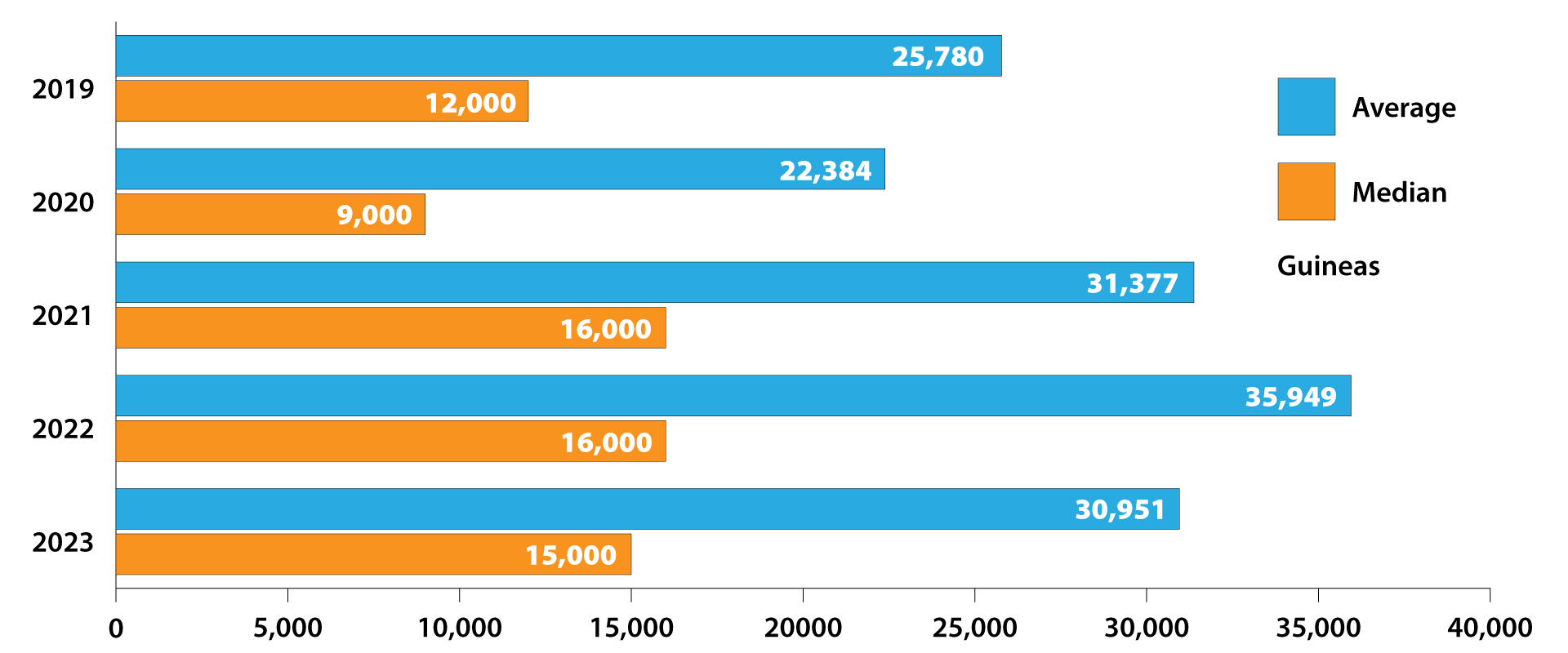

Since being taken over by Tattersalls Ireland five years ago, the Goresbridge Breeze-Up Sale has gone from strength to strength, and it took yet another great leap forward in 2023 with the records for average and median prices smashed, as we can see from the table on the right.

SUMMER SALES

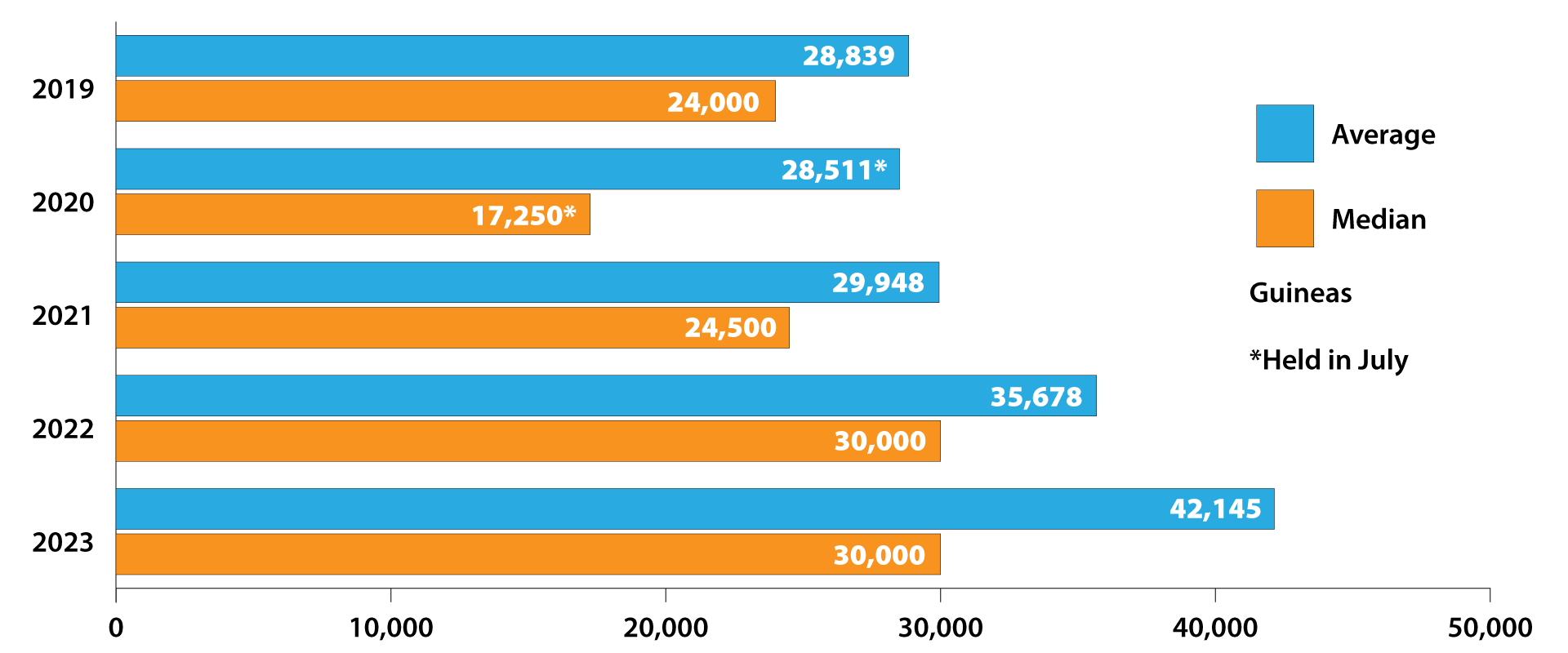

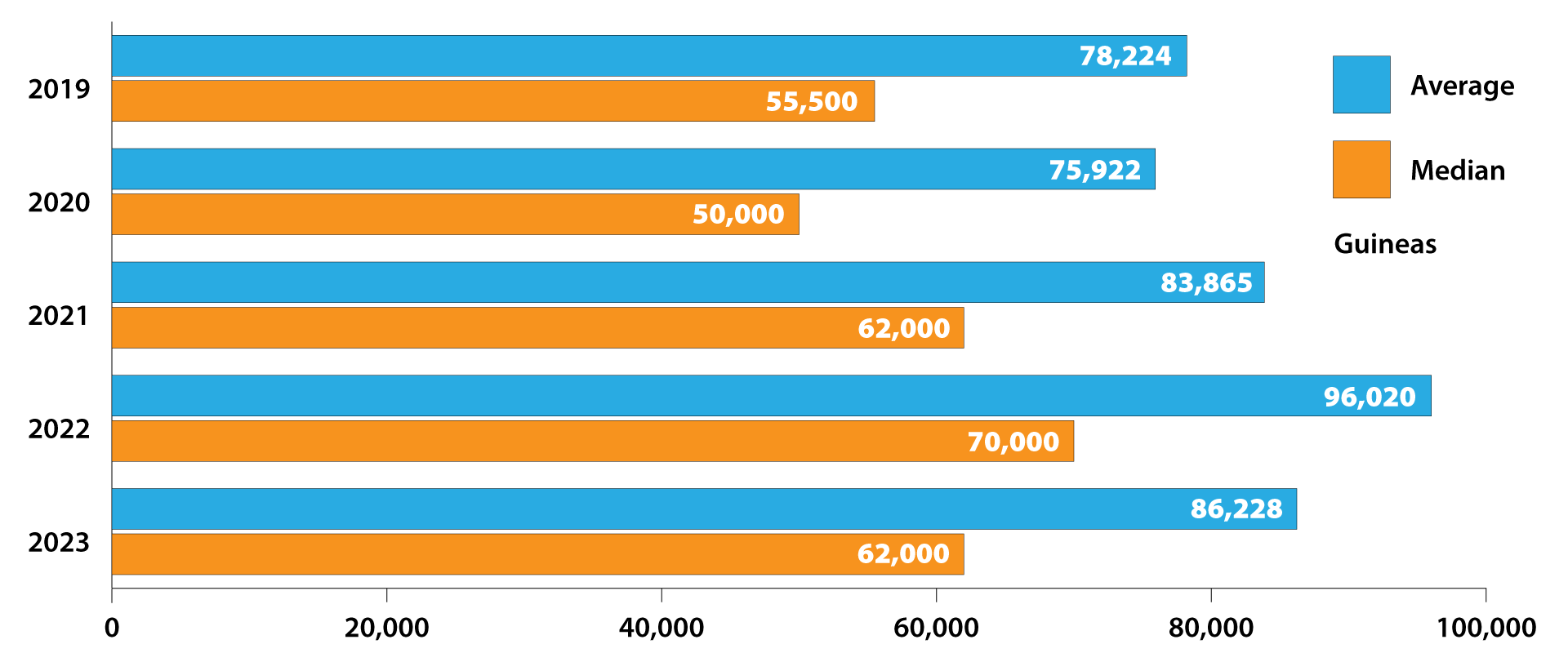

Tattersalls’ July Sale in Newmarket, one of the firm’s longest-standing auctions, tends to be another useful barometer. Recent years have seen major changes to the schedules. In the Covid-induced chaos of 2020, Tattersalls staged an additional sale in August, largely because the ever-changing regulations had still been very tight in July and a lot of horses were not able to make it to Park Paddocks then. Subsequently, the August Sale has remained as a fixture despite the world returning to normality (whatever that is nowadays) simply because the demand for opportunities to sell horses seems to be ever-expanding – to the extent that in 2023 the firm staged an additional one-day sale sandwiched between the two, the Summer Sale in the second half of July.

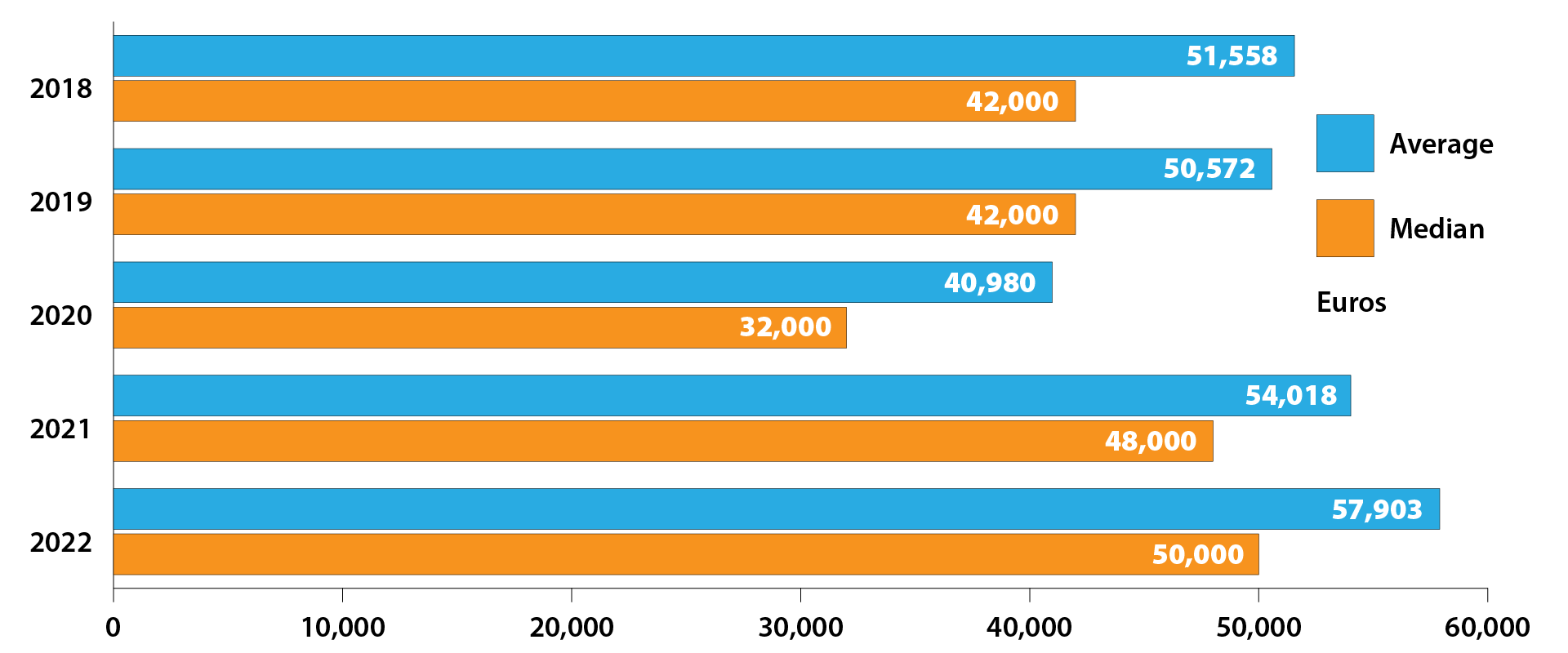

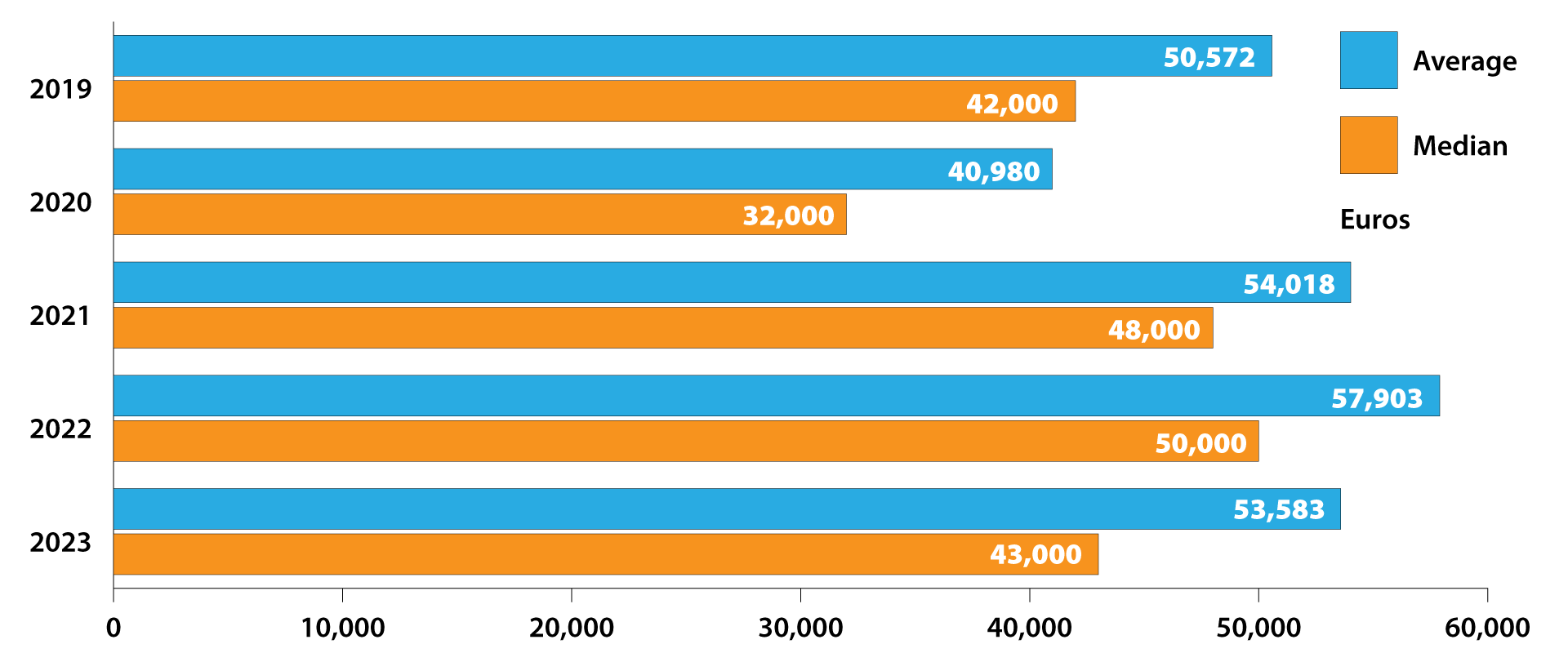

In 2023, these midsummer sales didn’t just tell us that supply is continually expanding; it also made it clear that demand is not increasing at the same rate. In 2023 the July Sale catalogue was the biggest ever, up by over 100 lots from the previous year, yet the aggregate increased only marginally and the average was noticeably lower. The August Sale was worse. The catalogue was very similar in size to the 2022 book (only one more lot was offered in 2023 than in 2022) but the average dropped by over a quarter and the median plummeted to the lowest figure ever recorded in the four-year history of the August Sale. Furthermore, trade at the new Summer Sale was very quiet.

YEARLING SALES

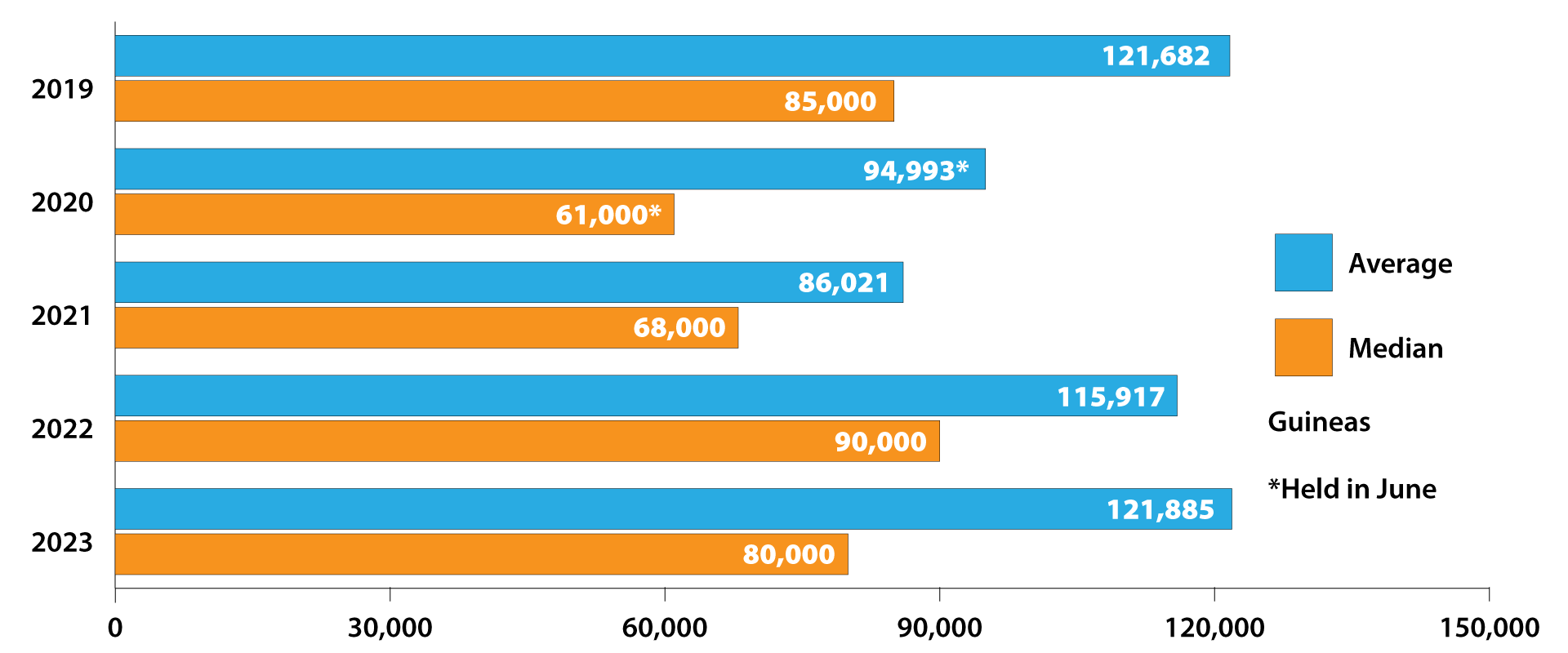

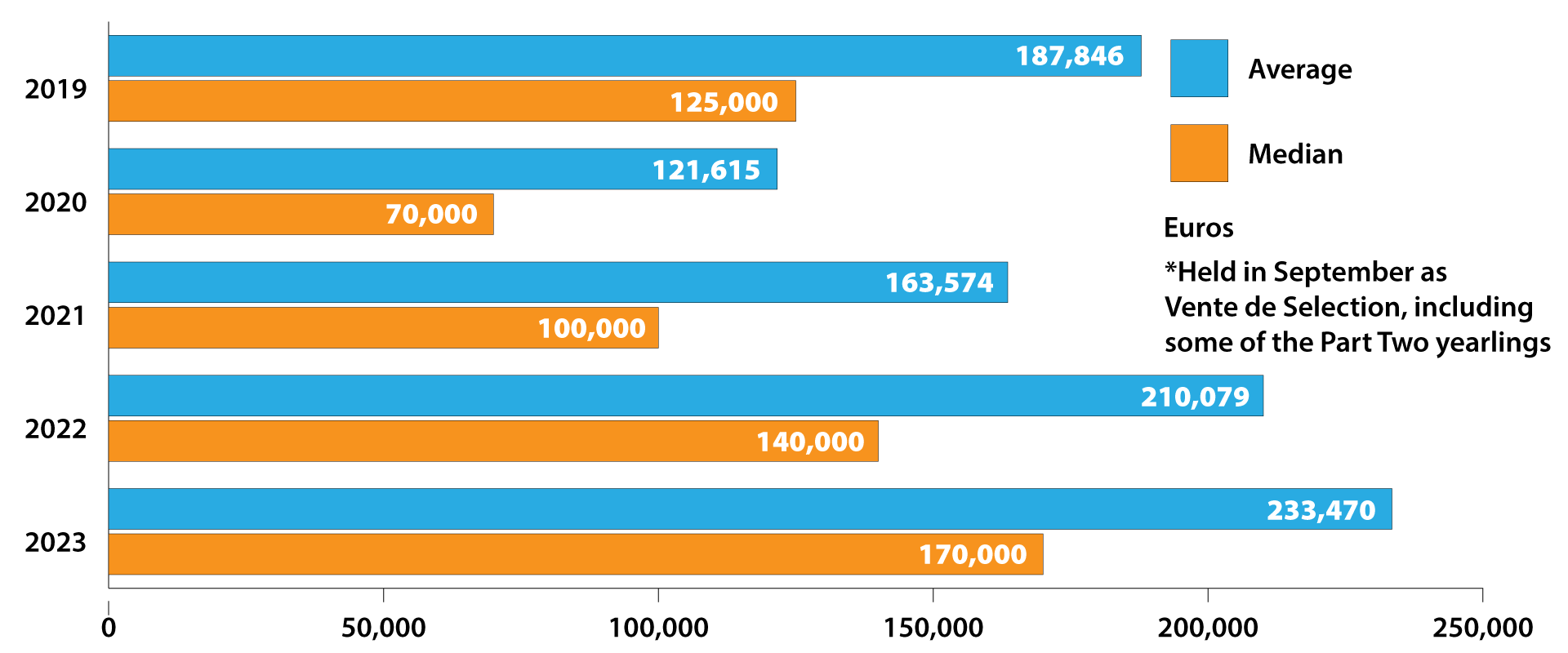

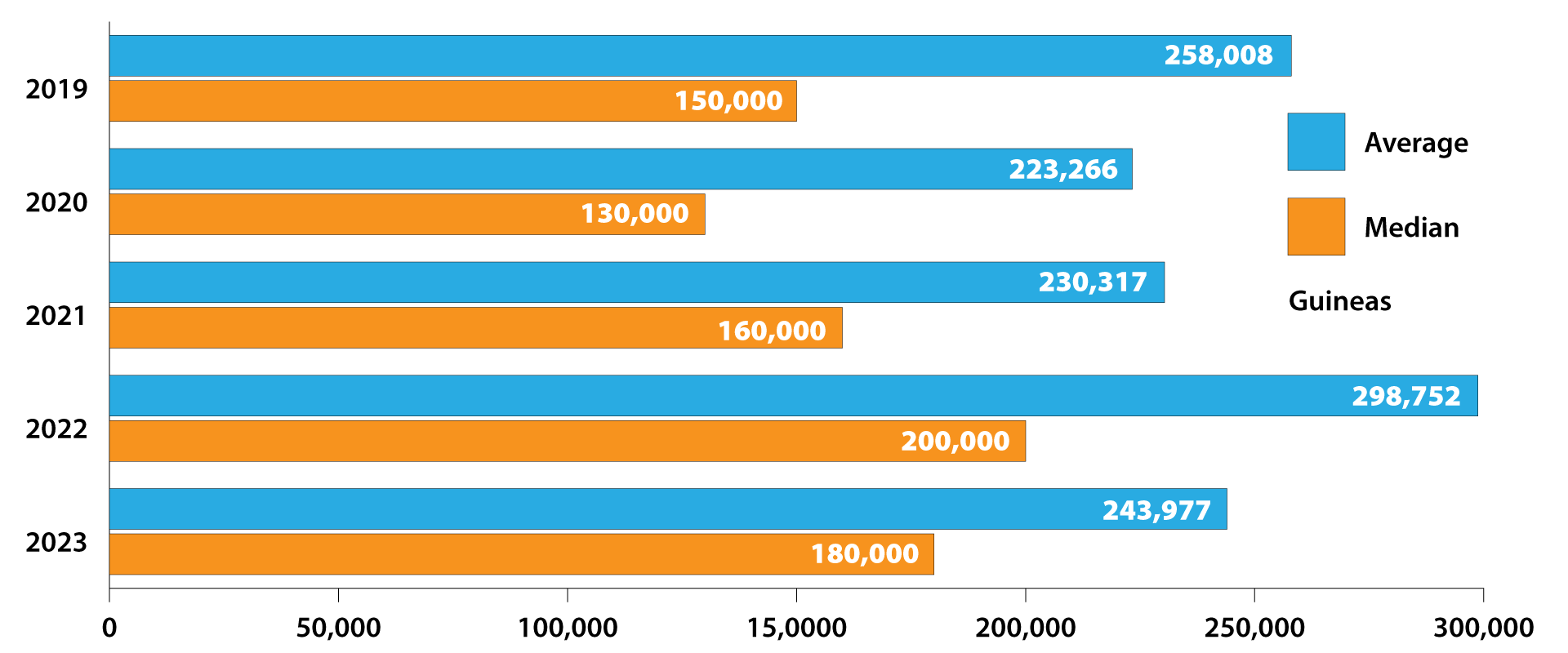

Arqana continues to go from strength to strength. Holding the first yearling sale of the season is an obvious advantage (albeit probably not for vendors of slower-developing yearlings or ones who have had a setback during the spring or summer) as all buyers have yet to start filling their order books and none are yet suffering from the ‘sales fatigue’.

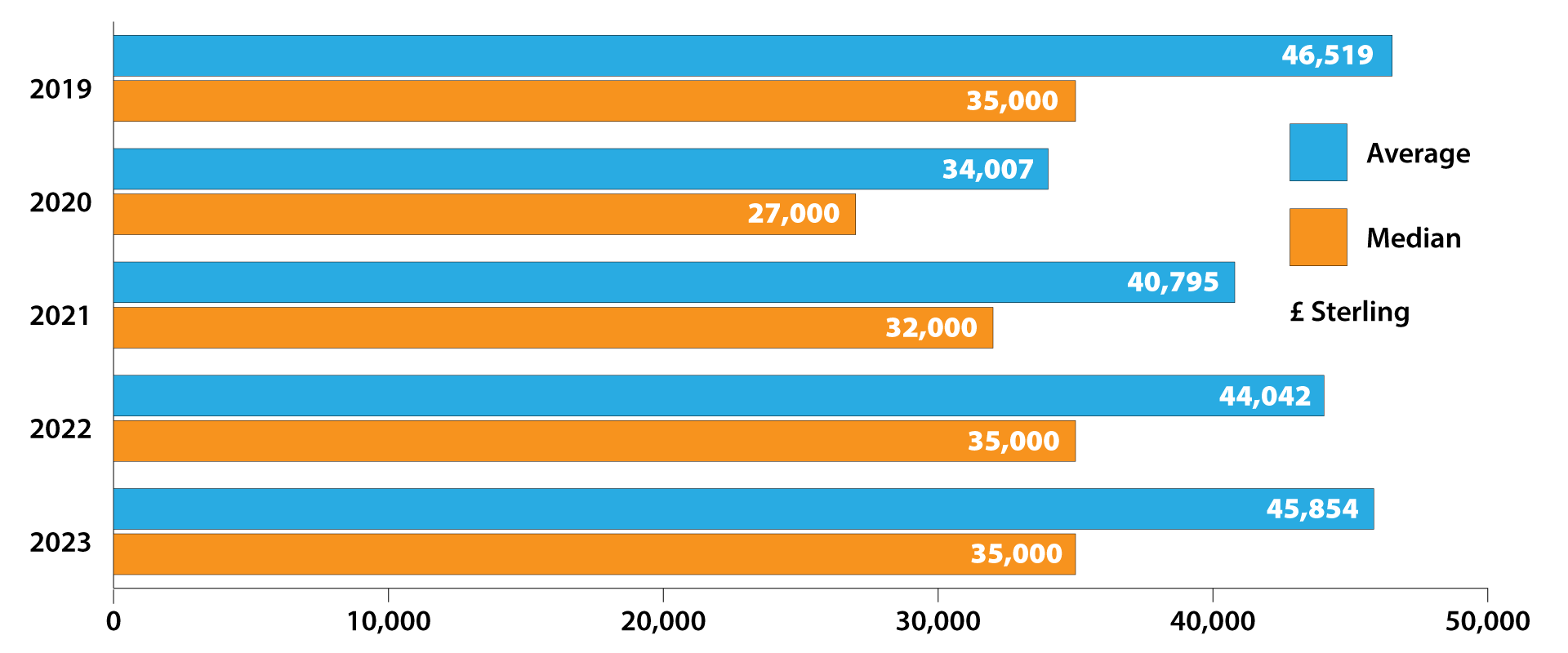

Tattersalls must surely be looking over their shoulders as Arqana’s August figures are closing on the returns from Book One of Tattersalls’ October Sale, although admittedly achieved from a much smaller catalogue. (There were only 236 yearlings offered at Deauville during its premier sale, compared to the 470 that went under the hammer during Tattersalls’ October Book One). The Premier Sale at Doncaster remains very solid, even if the figures from the final pre-Covid sale (2019) still have not quite been matched, despite the catalogue having become slightly more streamlined since then. Its record for churning out future two-year-old winners and star sprinters remains rock-solid, with its successful graduates over the past year headed by the Manister House Stud-bred Fev Rover - a dual Grade 1 winner in North America during 2023 - and including such leading juveniles of the past season as July Stakes winner Jasour, Princess Margaret Stakes heroine Sacred Angel and Redcar Two-Year-Old Trophy winner Dragon Leader.

The principal yearling sales in Ireland continue to hold their own. Goffs still has cause for frustration (even if it is too polite to say so) that so many Irish vendors prefer to sell their choicest lots in England, so it was pleasing to see two seven-figure lots in the Orby this year: a Frankel colt bought by MV Magnier from Camas Park Stud for €1,850,000 (above) and a New Bay filly bought by Amanda Skiffington from Ballylinch Stud for €1,650,000. The Autumn Yearling Sale was challenging however, as illustrated by the graph on the opposite page. At Tattersalls, all four parts of the October Sale showed a decline on the 2022 figures, but it would be an overreaction to say that this was drastic. Admittedly, this is an over-simplification, but basically trade merely fell back to 2021 levels after a mind-blowingly strong sale in 2022.

As far as Book One goes, there were several obvious reasons. One was that it appears to be the case that one of the most significant buyers in 2022 subsequently defaulted on the deals, which meant that the true figures were lower than those officially stated. Furthermore, the extent to which Sheikh Mohammed gets involved has a significant impact on the overall position of a sale. He was still a notable buyer in 2023, but much less so than in 2022 when it felt at times as if he was turning the clock back to those halcyon days when it almost seemed as if he wanted to buy every potentially good horse.

The results of his 2022 buying spree, incidentally, have so far been largely disappointing, so it was understandable that he might want to make less of a splash 12 months on. Godolphin did end the season by winning Britain’s final Group 1, the Kameko Futurity Trophy at Doncaster, with Ancient Wisdom, an Ecurie des Monceaux-bred Dubawi colt who had been the second most expensive yearling at the Arqana August Sale in Deauville at €2,000,000.

Coolmore’s high-priced purchases of 2022, on the other hand, have been more noticeably successful. Three of the top ten lots in Book One of that year’s Tattersalls’ October Sale were knocked down to MV Magnier and all have started their careers well. Most notably Ylang Ylang (1,500,000 guineas) won the Group 1 bet365 Fillies’ Mile at Newmarket. Otherwise, Diego Velazquez (2,400,000 guineas) won the Group 2 KPMG Champions Juvenile Stakes at Leopardstown (before, admittedly, disappointing in the Futurity) and Euphoric (1,900,000) went into plenty of notebooks when making a winning debut at Navan in October.

TATTERSALLS HORSES IN TRAINING SALE

No sale did more all year to illustrate that supply is greatly outstripping demand than Tattersalls’ Autumn Horses-in-Training Sale. This year saw the largest catalogue ever assembled, containing 192 lots more than last year’s 1,564. The sale also went up from four days to five. The figures went the other way, though, the aggregate (33,705,774 guineas) falling by nearly 2.5m guineas; the average dropped by approximately 15%; and the median was down by 1,000 guineas.

Tattersalls’ Autumn Sale always depends very heavily on overseas buyers. This year they came, as usual, from all around the world. Australian buyers were the most notable, seemingly eager to snap up any horses with a vague pretension to being suitable for a Melbourne Cup. In his closing statement, Tattersalls Chairman Edmond Mahoney referred to “a particularly strong contingent of Australian buyers”, observing that collectively that had accounted for “10 of the top 20 highest-priced horses sold this week”, and that “nearly 50 horses in total are heading down to Australia”.

NATIONAL HUNT SALES

By contrast with the trade for flat horses, national hunt racing is a purely domestic concern, apart from the occasional good horse being recruited from Ireland or Britain to run in America. Happily, it remains a very strong market, with generally the figures at the principal store sales in the summer at Kill and Fairyhouse more than holding up, the lull during Covid being but a distant memory. If one wants really to see the strength of the demand for potentially smart jumpers, though, the ever-expanding number of ‘boutique’ sales of (generally) lightly-raced point-to-pointers, novice hurdlers or bumper horses probably provides the best illustrations, showing that the allure of owning a horse who might possibly be good enough to win at (or even run at) the Cheltenham Festival is at least as strong as it has ever been.

END-OF-YEAR SALES

By definition, the bloodstock pyramid sees far fewer horses at the elite level of the game than in the lower tiers, and the market recently has been providing ever more cases of ‘feast or famine’. In an era of ongoing over-production, this is inevitable and understandable: demand remains very high for the elite few, but at all the lower levels supply far exceeds demand.

Goffs’ November Breeding Sale provided a perfect illustration of this situation after the company had pulled off a great coup in securing a draft of horses from the Niarchos family’s studs in what was described as a “restructuring” of the operation rather than a dispersal. Overall, the sale’s median dropped by 25% from the heights which it had reached in 2022, but the presence in the catalogue of the relatively small number of Niarchos mares was the major factor in both the average and the aggregate more than doubling. The aggregate, having been just over €16,000,000 in both 2021 and 2022, rocketed up to €40,751,500.

This was a vintage November Sale, helped greatly but not solely by the presence of the Niarchos mares. Godolphin always sends some nice horses to this sale but the 14-year-old Authorized mare Ambivalent, a Group 1 winner who has already produced a Group 1 winner, was a standout, particularly as, being in foal to Sea The Stars, she was carrying a full sibling to her star daughter, the 2021 Prix Vermeille heroine Teona. Ambivalent’s price of €925,000 would have made her easily the top lot at any other recent November Sale; as it was, she was only the sixth highest-priced mare in the auction.

The 2022 Cheshire Oaks heroine Thoughts Of June, in foal to No Nay Never, fetched €2m in what appeared to be a case of one partner (Moyglare Stud) buying out another (Coolmore). Even she, though, only came in at Number Five, with four Niarchos mares each fetching well in excess of €3m. The bill was topped jointly by the half-sisters Alpha Centauri and Alpine Star. The pair, winners of five Group 1 races between them and carrying respectively to Sea The Stars and Frankel, each fetched €6m, knocked down, like the two other mega-expensive Niarchos mares Albigna and That Which Is Not, to MV Magnier.

GOFFS NOVEMBER BREEDING STOCK SALE

| Year | Avarage | Median € |

|---|---|---|

| 2023 | 124,623 | 18,000 |

| 2022 | 55,398 | 24,000 |

| 2021 | 43,809 | 17,000 |

| 2020 | 31,674 | 14,000 |

| 2019 | 33,153 | 14,000 |

Being largely dependent on speculators who buy to resell the following autumn, trade in foals is ever vulnerable to dips in the market. Happily, though, it held up well at Goffs. This was not the case in Newmarket where there was a marked decline over the four days of foal selling during Tattersalls’ December Sale. At Goffs, while there had been a slight decline in the average, the median, often the best indicator of the health of any market, held firm. Not so at Tattersalls, where it dropped from 26,000 guineas to 21,000. Furthermore, the aggregate fell alarmingly from 35,255,050 guineas to 29,842,902 guineas. At a lot of sales during the year where the high figures of 2022 could not be maintained, the drop was down to roughly the 2021 levels; the decline was greater than that here, with the median falling beyond even the immediate pre-COVID figure.

What was particularly disappointing about the decline in ‘investment’ in foals at Newmarket was that there was, relatively speaking, plenty of activity by people who wanted to buy foals to race. The top lot, a filly by St Mark’s Basilica from the 2013 Oaks heroine Talent, was bought by Jill Lamb on behalf of Newsells Park Stud, whose owners, Mr and Mrs Smith-Bernal, intend to race her themselves. The next half-dozen priciest foals were bought by MV Magnier, Juddmonte Farms, Godolphin, Andrew Elliott on behalf of Amo Racing, Juddmonte Farms and Godolphin, and appear to have been bought to race. One thus had to go down to the eighth-dearest foal, a Sea The Stars colt bought for 330,000 guineas by Fran Woods of Abbeylands Farm, to find one seemingly bought for resale.

Another notable aspect of the market was that, even by the standards of an era in which stallions are either ‘hot’ or ‘cold’, it was alarming how quickly demand fell for the stock of stallions who were deemed to be going out of fashion. While foals by, say Havana Grey, sold like hot cakes, there were all too many perfectly adequate stallions whose offspring appeared to be almost completely ignored.

GOFFS NOVEMBER FOAL SALE

| Year | Avarage | Median € |

|---|---|---|

| 2023 | 36,420 | 24,000 |

| 2022 | 39,979 | 24,000 |

| 2021 | 34,872 | 22,000 |

| 2020 | 36,463 | 20,000 |

| 2019(PART ONE) | 49,088 | 30,000 |

| 2019(PART Two) | 6,481 | 4,200 |

TATTERSALLS DECEMBER SALE FOALS

| Year | Avarage | Median (GNS) |

|---|---|---|

| 2023 | 44,608 | 21,000 |

| 2022 | 47,386 | 26,000 |

| 2021 | 42,645 | 25,000 |

| 2020 | 41,807 | 20,000 |

| 2019 | 44,251 | 22,000 |

TATTERSALLS DECEMBER SALE YEARLINGS

| Year | Avarage | Median (GNS) |

|---|---|---|

| 2023 | 37,616 | 20,000 |

| 2022 | 34,627 | 22,000 |

| 2021 | 34,948 | 27,000 |

| 2020 | 32,675 | 20,000 |

| 2019 | 31,676 | 25,000 |